Corporate Lease

The corporate lease at Rockwell Pacific is designed to give your business an opportunity to acquire fixed and movable assets without putting a strain on your cash flow.

The finance lease is founded on the philosophy that profits are earned through usage and not through ownership of an asset. It was this very concept that fueled modern lease financing as an alternate method of financing.

How does it work?

All you have to do is identify an asset that you need for your business. Subsequent to a review of your business, Rockwell Pacific will purchase the equipment and provide you with unlimited usage for a predetermined repayment period structured according to agreed terms and conditions. An innovative offshoot of the finance lease allows you to release cash tied up in recently purchased assets through the ‘sale and lease back’ transaction, which increases the working capital available to your business.

Rockwell Pacific has provided comprehensive leasing services to companies across the country for three decades. We offer a personal touch and customized approach placing all of our clients on even footing. We provide financing on a wide range of equipment and commercial vehicles together with attractive and customized repayment terms. This sense of fair play has been one of the foremost reasons and principles behind Rockwell Pacific’s success.

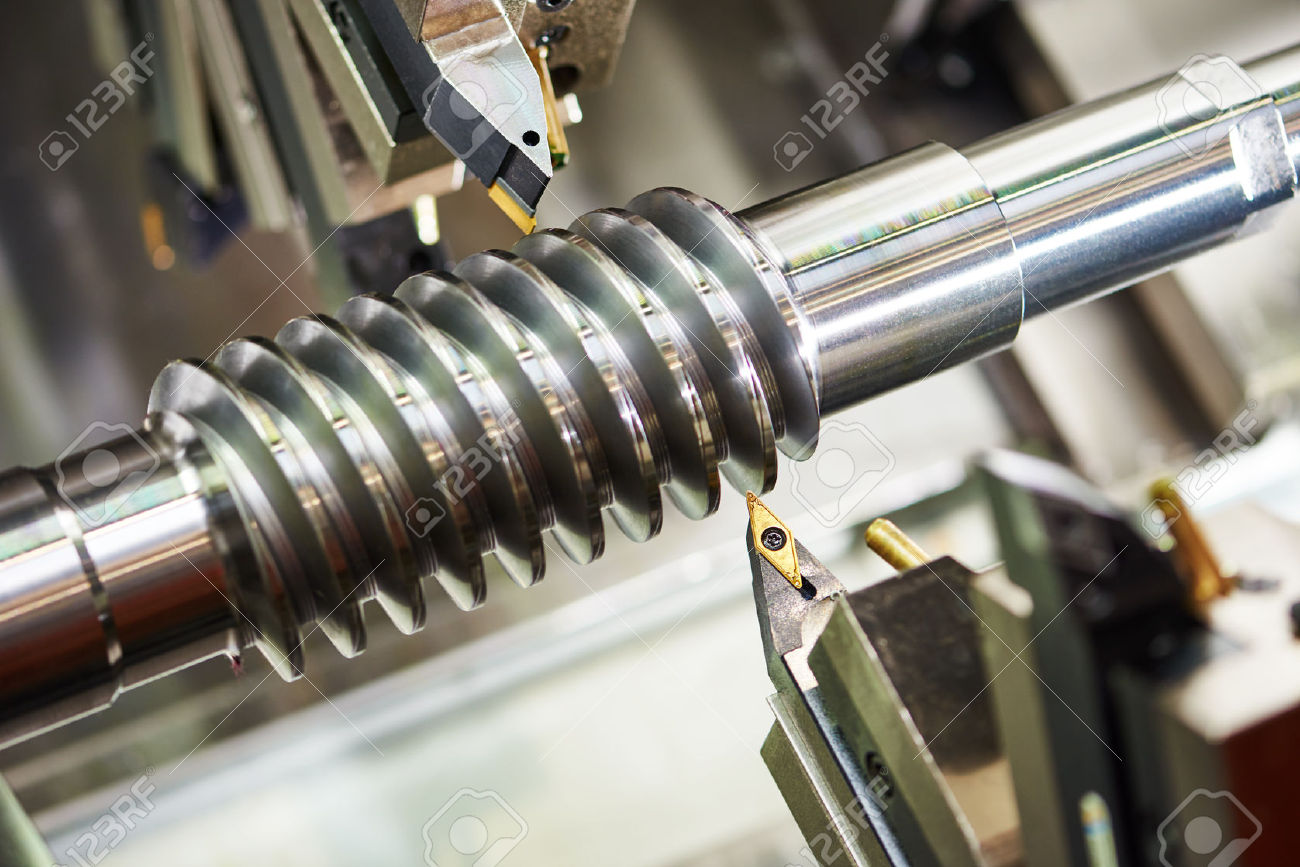

Rockwell Pacific offers Lease Financing on a variety of new and used assets:

• Construction & Transportation

• Commercial

• Industrial & Material Handling

• Agriculture

• Office & Telecommunications

• Medical & Dental

Features

Below are the flexible leasing options tailored to suit your business requirements:

- Fixed rate financing (your lease payment never changes, making for simplified budgeting and a hedge against inflation)

- Step lease (balloon payments or seasonally adjusted payments to meet cash flow variances)

- Deferred payment leases (defer payments for up to 90 days)

- Sale and lease back (free up working capital for other business development requirements)

- Rockwell Pacific assumes the economic ownership of the asset whereas the lessee will avail the economic usage.

- Leasing may lead to tax savings as lease rentals in many cases can be treated as tax deductible expenses

- Leasing guards against obsolescence and is a good hedge against inflation

Eligibility

Rockwell Pacific will consider inquiries from all commercial entities on most types of equipment and commercial vehicles. We consider applications from organizations that have a successful track record of the past three year’s operations, Rockwell Pacific also provides new business financing that has specific start up criteria.